maine tax rates by town

Foreclosure Homes in Maine. Below we have highlighted a number of tax rates ranks and measures detailing Maines income tax business tax sales tax and property tax systems.

Maine S Coast Into A Hotbed Of Summer Tourism And Gardening And Nowhere Is That More True Than Vacationl Desert Island Most Visited National Parks Maine Coast

The County sales tax rate is.

. This is the total of state county and city sales tax rates. HAMPTON FALLS Selectmen have received the official 2021 property tax rate for the town from the state Department of Revenue Administration. The exact property tax levied depends on the county in Maine the property is located in.

27 rows Maine Relocation Services Local Tax Rates. Choose your locality to find the contact information of your local tax assessor. The Old Town sales tax rate is.

Lowest sales tax 55 Highest sales tax 55. Local government in Maine is primarily. Welcome to Maine Home Connection your comprehensive guide to Greater Portland real estate and the communities of southern Maine.

Town Residential Tax Mill Rate Commercial Tax Mill Rate. Auburn ME Sales Tax Rate. The minimum combined 2022 sales tax rate for Old Town Maine is.

Tax Data Statistics. Each states tax code is a multifaceted system with many moving parts and Maine is no exception. Kennebecs average effective property tax rate of 137 however comes in above Maines 130 statewide average effective rate.

The statewide median rate is 1430 for every 1000 of assessed value. 2022 List of Maine Local Sales Tax Rates. The Town of Yorks 20212022 taxable valuation is 5500701250.

The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July 1 2021 to June 30 2022. City Total Sales Tax Rate. Penobscot County has 20 towns and cities with their own local tax assessors offices.

Map numbers start with U or R followed by a dash and the map number. Yorks certified assessment ratio for 20212022 is 100. Cumberland County collects the highest property tax in Maine levying an average of 297300 12 of median home value yearly in property taxes while Washington County has the lowest property tax in the state collecting an average tax of 106500 104 of median home value.

Augusta ME Sales Tax. Maine property tax rates by town the master financial services platform business ine tax rate 2016 contents unanized territory tax maps and valuation ings property. Yes No The Real Property Tax Service of Broome County seeks to improve the administration and understanding of the real property tax.

At the median rate the tax bill on a property assessed at 100000 would be. Where is the Penobscot County Tax Assessors Office. The new rate applies to the taxes due on October 15 2021 and March 15 2022.

Property tax rates are also referred to as property mill rates. Current Revenue Sharing Projections. Androscoggin County has the highest property tax rate in the state of Maine.

The total assessed valuation of exempt property is currently 249707600. Kennebec has a lower median home value 155000 than other more expensive counties in Maine. City Sales Tax Rate Tax Jurisdiction.

Nike Shoe Size Chart Mens. Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466 EASTON 1595. The Maine sales tax rate is currently.

Do not try to match names exactly as there are many variations in the database which make it difficult to find exact matches. How does Maine rank. Org Chart Template Excel.

If the home value is 500000 or less the county transfer tax is 1 and if the home value is more than 500000 the transfer tax is 1425. FY22 Tax rate is 80for the period of July 1 2021- June 30 2022. The first step towards understanding Maines tax code is knowing the basics.

Fall tax bills are being sent out within the week of the final tax rate being set. 13 rows Tax Rates The following is a list of individual tax rates applied to property located in. An important resource for municipal governments in Maine.

This includes taxable real estate valuation of 5478745100 and taxable business personal property valuation of 21956150.

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

Maine Property Tax Calculator Smartasset

Maine Sales Tax Small Business Guide Truic

Maine State Economic Profile Rich States Poor States

Maine Estate Tax Everything You Need To Know Smartasset

Maine Sales Tax Guide And Calculator 2022 Taxjar

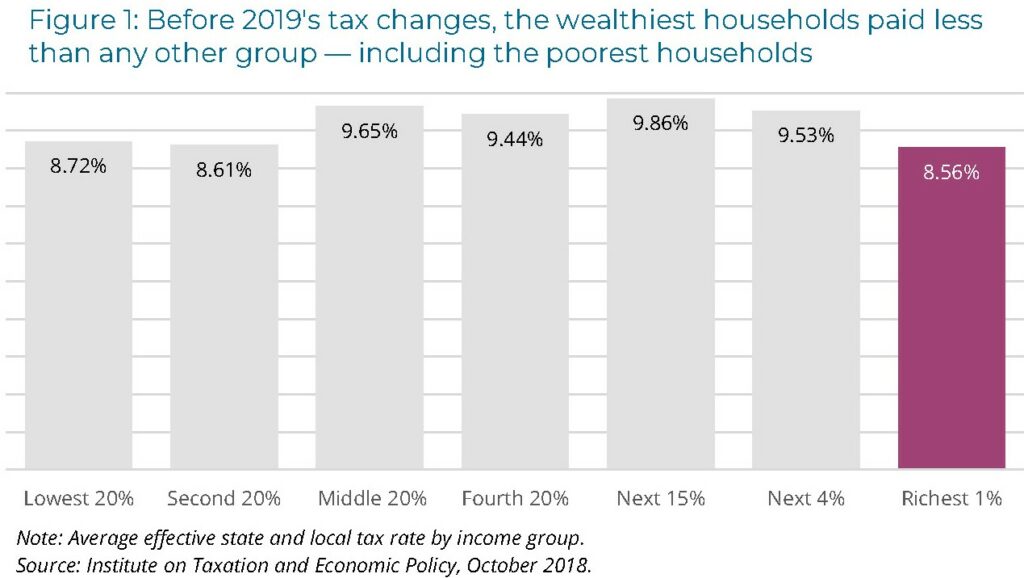

Maine Reaches Tax Fairness Milestone Itep

Tax Maps And Valuation Listings Maine Revenue Services

The Government Is Reforming The Tax System Here Is What You Need To Know Dutchnews Nl Tax Paying Taxes Holiday Pay

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

What Is The Cost Of Living In Maine Smartasset

Maine Reaches Tax Fairness Milestone Itep

Maine Income Tax Brackets 2020

Ask Hannah Holmes Your Home Maintenance Questions Answered Home Maintenance Old Farm Houses Old Farm